springfield mo city sales tax rate

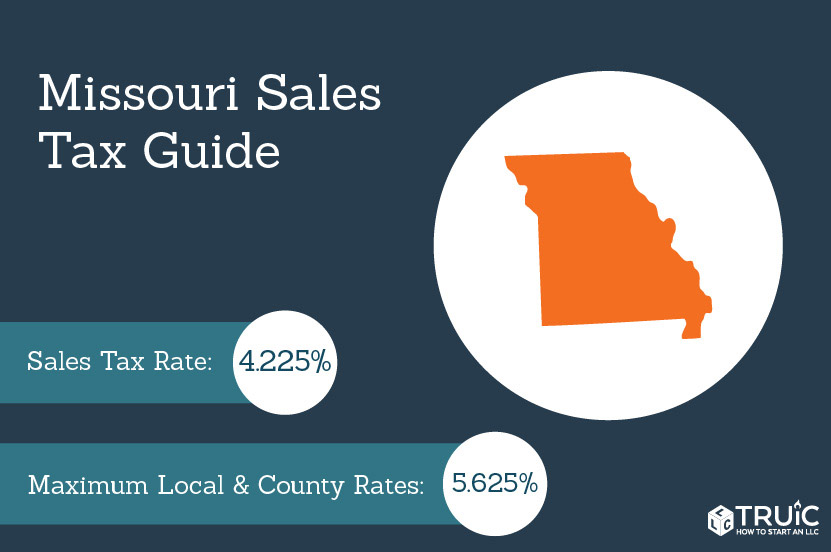

Missouri has state sales tax of 4225 and allows local governments to collect a local option sales tax of up to 5375. The Springfield City Code Chapter 70 Article V requires hotels motels and tourist courts to pay a tax equal to 5 of the gross rental receipts paid by transient guests for sleeping accommodations.

Highest Gas Tax In The U S By State 2022 Statista

Did South Dakota v.

. Since the tax is on the hotel motel or tourist court and. The 4225 percent state sales and use tax is distributed into four funds to finance portions of state government General Revenue 30 percent Conservation 0125 percent Education 10 percent and ParksSoils 010 percent. Sales Tax - may be imposed in 18 0125 increments up to a maximum of 1 if approved by majority vote of qualified voters in the district.

Springfield MO 65802 Phone. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781. The Springfield City Code Chapter 70 Article V requires hotels motels and tourist courts to pay a tax equal to 5 of the gross rental receipts.

2020 rates included for use while preparing your income tax deduction. If you have questions regarding the rates please. Special taxing districts such as fire districts may.

State sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax and a 213 city sales tax. Home Rule Sales Tax - imposed on a sellers receipts from sales of tangible personal property for use or consumption at the rate of 25. What is the sales tax rate in Springfield Missouri.

The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax. Section 144014 RSMo provides a reduced tax rate for certain food sales. Average Sales Tax With Local.

City of Springfield Busch Municipal Building 840 Boonville Avenue Springfield MO 65802 Phone. Over the past year there have been 98 local sales tax rate changes in Missouri. Police Fire or EMS dispatch.

17 rows City Sales Tax City County and State taxes Knoxville TN. Did South Dakota v. The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax and a 213 city sales tax.

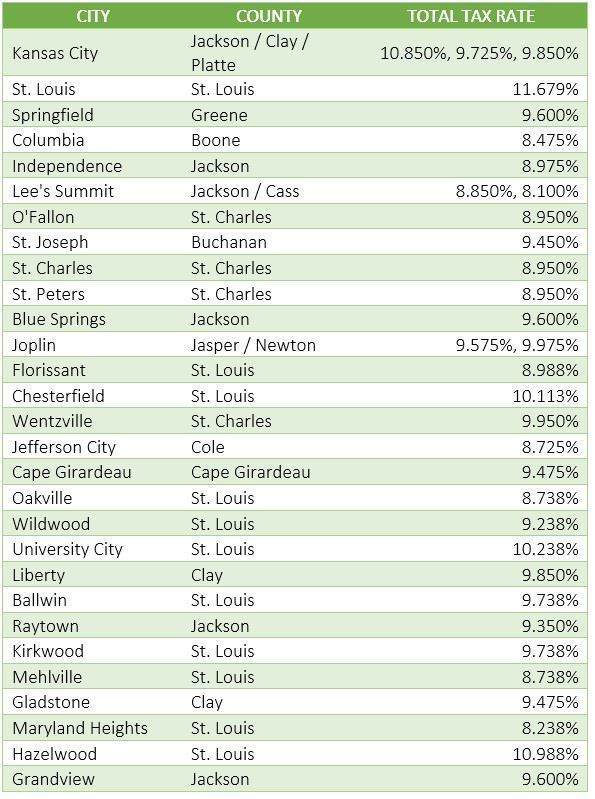

The base sales tax rate is 81. What is the sales tax rate in the City of Springfield. 2022 List of Missouri Local Sales Tax Rates.

There are a total of 741 local tax jurisdictions across. The latest sales tax rates for cities in Missouri MO state. If your rate differs or changes these examples may not be valid.

Springfield collects a 3375 local sales tax the maximum local. Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 9355. Rates include state county and city taxes.

This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. Lowered from 9225 to 8225 Monroe City. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax.

Find Sales and Use Tax Rates. Lowest sales tax 4725 Highest sales tax 11988 Missouri Sales Tax. Raised from 81 to 91 Kaiser.

Missouri has a lower state. Enter your street address and city or zip code to view the sales and use tax rate information for your address. The rate for food sales was reduced by 3 from 4225 to 1225.

For tax rates in other cities see Missouri sales taxes by city and county. Are room rentals to sales tax exempt customers exempt from hotelmotel tax. The minimum combined 2022 sales tax rate for Springfield Missouri is.

You can print a 81 sales tax table here. The City of Springfield will consider the establishment of Community Improvement Districts to finance public improvements andor public services that will directly benefit the property owners. SalesUse Tax Rate Tables.

Missouri has state sales tax of 4225 and allows local governments to collect a local option sales tax of up to 5375. Cities and counties may impose a local sales and use tax. The following is a list with a brief description of taxes collected.

417-864-1000 Email Us Emergency Numbers. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax. The current total local sales tax rate in Springfield MO is 8100.

Please note the following examples are based on a sales tax rate of 81. This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175. The Springfield sales tax rate is.

Indicates required field. 417-864-1000 Email Us Emergency Numbers. The Springfield Sales Tax is collected by the merchant on all qualifying sales made within Springfield.

The County sales tax rate is. This is the total of state county and city sales tax rates. Select a year for the tax rates you need.

The Missouri sales tax rate is currently. The taxes are collected and administered by the state the county or the City of Springfield Office of Budget and Management. There is no applicable special tax.

Missouri has 1090 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Police Fire or EMS dispatch.

Sales Tax On Grocery Items Taxjar

States Are Imposing A Netflix And Spotify Tax To Raise Money

Missouri Income Tax Rate And Brackets H R Block

Setting Up Sales Tax In Quickbooks Online

Missouri Car Sales Tax Calculator

2nd Tax On Receipts Confuses Customers At New Walmart Youtube

Missouri Sales Tax Rates By City County 2022

Nebraska Sales Tax Rates By City County 2022

Missouri Sales Tax Small Business Guide Truic

The 2001 And 2003 Tax Relief The Benefit Of Lower Tax Rates Tax Foundation

New York Sales Tax Rates By City County 2022

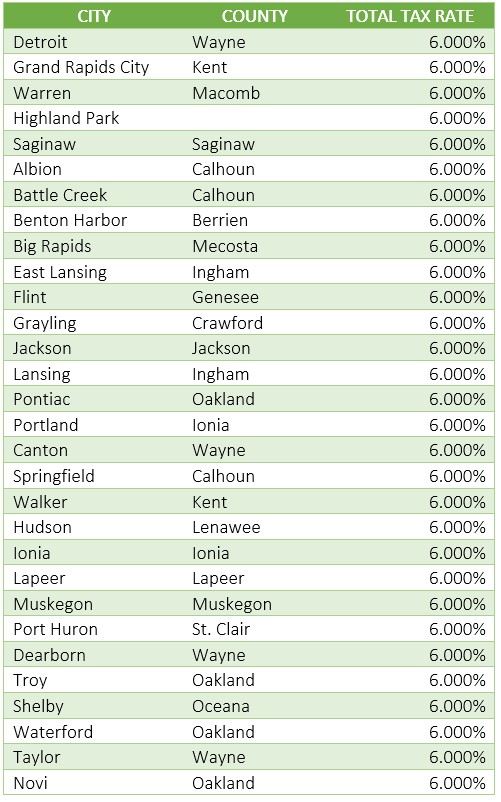

Michigan Sales Tax Guide For Businesses

Taxes Springfield Regional Economic Partnership